What is Good Operating Working Capital – Introducing the Setpoint Theorem

This article explains what good operating working capital looks like, what affects this level, and why it is important to maintain.

It also introduces the operating working capital Setpoint theorem. This suggests all companies have an optimal level it should maintain in order to successfully support its day to day operations, as well as facilitating growth and profitability.

Key Take Aways

- Companies require a certain level of Operating Working Capital to operate smoothly and support day-to-day activities. This equilibrium can be called a company’s operating working capital Setpoint.

- Too much operating working capital indicates an inefficient use of resources. On the other hand, too little can cause process inefficiencies and lost sales. However, to read these symptoms companies must first understand their Setpoint.

- Operating at a company’s optimal operating working capital level does not only optimize the Cash Conversion Cycle. It also facilitates growth and profitability.

- An operating working capital Setpoint cannot be derived from the balance sheet but must be calculated from transaction data.

- The Setpoint does not reflect a fixed but rather a dependable variable, e.g., Days Sales Outstanding, Days Payables Outstanding, Days Inventory Outstanding. Read more about Working Capital Metrics here.

- There is not one operating working capital Setpoint level that can be applied to all businesses. Rather, it depends on the industry and company specific supply chain conditions and constraints.

Want to own this article? Download it for free at MyAcademyHub.com

What is Good Operating Working Capital – How Much Should a Company Carry?

Operating working capital optimization is not about wildly cutting inventories or running the business on a shoestring. It is about understanding the circumstances of a business, making sure you are not under- or over-serving customers. Tailoring operations to strike a balance between service and cost.

The winner is not necessarily the one with the least operating working capital. It is the one with the right operating working capital.

Companies require a certain level of operating working capital to effectively support its operations and a healthy cash flow. The trick is understanding how much this is to avoid creating inefficiencies along the way.

- Too much operating working capital is an indication of inefficient use of resources, as idle assets cannot generate returns, and cost money to maintain. It could further mean that a company has less cash to invest and grow, as more capital is used to fund the company’s operating cycle.

- On the other hand, too little operating working capital can lead to process inefficiencies and lost sales, impacting the profitability of a business.

The challenge is of course, to read and act on these symptoms, a company must first understand and its baseline operating working capital requirements. We call this equilibrium a company’s operating working capital Setpoint.

Properly applied, a company’s Setpoint denotes an operating working capital steady state. From this state all processes operate in harmony, providing perfect value for the end-customer with as little friction and waste as possible.

This impacts not only the operating working capital but also top-line and profitability.

Learn more about the importance of managing working capital – take our accredited e-learning course Managing Working Capital on MyAcademyHub.com!

What Affects a Company’s Operating Working Capital?

A company’s operating working capital requirements depend on its inherent supply chain conditions and constraints, but also how efficiently it operates, its size, seasonality, and growth of the business.

- Inherent supply chain conditions and constraints. Industry standards, commercial prerequisites and a company’s individual supply chain set-up determine its operating working capital requirements. Operating below this level will cause inefficiencies with a long-term negative effect on cash-flow, profitability, and growth potential.

- Operating efficiency. Supply chain and process inefficiencies left untreated drives excess operating working capital. This could include the build-up of higher inventory reserves to offset e.g., poor supplier delivery performance, inaccurate forecasts, or frequent last-minute changes to frozen production plans.

- Size of the business. Operating working capital requirements are relative to the volume of the business it is supporting. The larger the business, the higher its operating working capital requirements will be in absolute value.

A company with sales of $100m with an average customer payment term of 30 days will have $8m in its accounts receivable (30/365*100), assuming all customers pay on time. A similar company double the size would have $16m in its accounts receivable (30/365*200). - Seasonality. Certain industries experience seasonality in demand, where sales volumes might peak at certain periods. This will influence inventory levels, accounts receivable and accounts payable levels across the year.

As an example, clothing retail companies often stock up inventories ahead of peak seasons. Also, producing companies with demand spikes higher than current production capacity often produce ahead of time. - Growth. As operating working capital is relative to the business it is supporting; growth will impact its operating working capital requirements.

A company growing 20% in sales will see its operating working capital grow 20% (or more), assuming no changes to its inherent supply chain conditions and constraints.

Regular monitoring and adjustment of a company’s working capital Setpoint level in response to changing circumstances are essential for maintaining financial health, operational efficiency, and maximizing shareholder value.

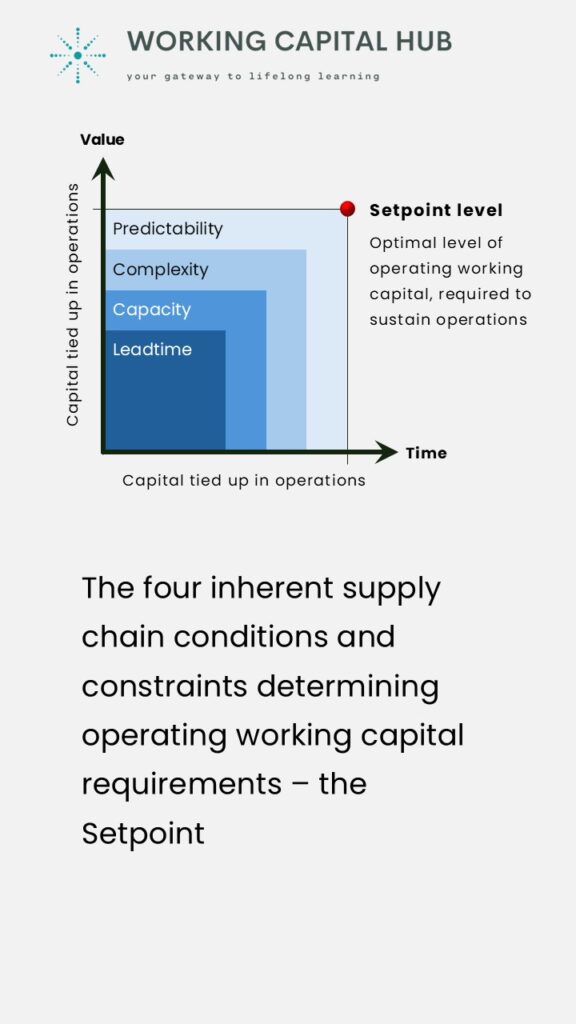

What Are a Company’s Inherent Supply Chain Conditions and Constraints?

In the context of operating working capital, a company’s supply chain conditions and constraints can be categorized into 4 main elements:

- Lead Time. Refers to the time it takes to complete a task, e.g., sourcing or producing materials, receiving payments from customers, paying suppliers, etc.

Longer lead times mean tying up more capital in inventory and other operational expenses for a longer duration before generating sales and cash inflow. - Capacity. Refers to the set limitation of a business’s ability to perform a service or product delivery within a certain timeframe.

To meet a current or future demand beyond these capacity constraints, a company must build up sufficient buffers to cope (e.g., increased lead time or volume). - Complexity. Refers to complexity in business operations. This tend to increase the need for operating working capital by introducing variability, uncertainty and inefficiencies that require additional resources to manage effectively.

E.g., a driver of increased complexity could be the introduction of multiple variations of the same product or multiple inventory locations. - Predictability. Refers to the predictability of customer and supplier interactions over time. These affect a company’s ability to allocate its resources as effectively as possible.

A company’s supply chain conditions and constraints are defined by a myriad of factors. These include industry standards within the company’s chosen field, any commercial prerequisites attached to its target markets, as well as the organization’s chosen supply chain set-up and structure.

These four elements combined will determine how much operating working capital a company must carry to effectively support its operations. Maintaining this level enables peak efficiency, optimizing not only working capital and cash-flow, but also top-line and cost.

What is an Operating Working Capital Setpoint?

The ideal balance of not-to-much and not-too-little operating working capital is what we call a company’s Setpoint.

This is the level of operating working capital a company must sustain in order to effectively support its current operational set-up, effectively manage and sustain its external relationships, as well as facilitate strategic directives regarding growth and profitability.

The operating working capital Setpoint includes a company’s ideal level of healthy inventory, required to produce and deliver on-time and in-full, as well as its ideal in- and outflow of cash, reflecting the commercial terms of its existing customer and supplier agreements.

Any sustained reduction of operating working capital below the current Setpoint level requires a structural change to the company’s underlying supply chain conditions and constraints.

Each operating working capital component has its own Setpoint target. Performance above or below indicates inefficiency:

- Operating above the Setpoint level suggests an inefficient use of a company’s resources, as idle assets cannot generate returns. Excess levels are also strong symptoms of hidden process inefficiencies, resulting in inventory buffers, inefficient invoicing- and collection processes, as well as lax purchasing practices.

In essence, excess operating working capital signals a misalignment between the company’s operational needs and its operating working capital resources. This hinders its ability to capitalize on growth opportunities and maximize profitability. - On the other hand, operating below the Setpoint level will create process inefficiencies. This is because the company may struggle to meet customer demand due to insufficient inventory or production capacity. This can in turn lead to missed sales opportunities, costly overnight shipments, delayed deliveries, and strained relationships with customers.

Moreover, too low levels of operating working capital can place a company in a state of perpetual firefighting. This limits its ability to proactively take advantage of supplier discounts or negotiate favorable terms, further exacerbating cost pressures.

In essence, operating below the optimal working capital level constrains the company’s ability to operate efficiently, compete effectively, and sustain long-term growth.

Calculating an Operating Working Capital Setpoint

A Setpoint cannot be derived from the balance sheet but must be calculated from transactional data.

- Calculating the Inventory Setpoint. The inventory Setpoint represents a company’s required level of inventories, based on current system applied planning parameters.

It is calculated by stock keeping unit (SKU) based on individual replenishment lead time, demand profile and variability, minimum purchasing- or production quantities, as well as its set service level and safety stock requirements.

In cases where a SKU is kept at multiple stock locations, separate calculations should be made by location. - Calculating the Accounts Receivable Setpoint. The Accounts Receivable Setpoint represents a company’s required level of unpaid customer credits, based on its contractual customer payment terms.

It is calculated as the weighted average of all sales transactions in the last 12 months. It looks at each transaction’s value and specific customers’ payment term. - Calculating the Accounts Payable Setpoint. The Accounts Payable Setpoint represents a company’s required level of unpaid supplier credits, based on its contractual supplier payment terms.

It is calculated as the weighted average of all purchase transactions in the last 12 months. It looks at each transaction’s value and specific supplier’s payment term.

Note that each operating working capital Setpoint is expressed in days, not value. To convert to an indicative monthly value, companies can look at its sales profile across the year and calculate monthly balances.

Why is the Operating Working Capital Setpoint Important?

Operating working capital can serve as an insightful diagnostic tool, uncovering underlying inefficiencies in your organization’s supply chain processes.

This is because elevated operating working capital levels often result from these inefficiencies, acting as early warning signs.

Carrying excess inventory buffers or maintaining unbalanced receivables and payables comes at a cost. This will tie up valuable funds that could be better invested in growth or other value creating activities.

And while these safety mechanisms might provide immediate relief, they also remove the sense of urgency to address the root cause of the issues, alternatively contribute to overall supply chain optimization.

The ability to read and act on these symptoms provides valuable insights into which areas could be improved and optimized.

The challenge is, of course, that in order to do so, you would first have to understand and gauge what your baseline operating working capital requirements are to begin with – your Setpoint.

Aiming to improve a company’s operating working capital without first understanding what levels are required to effectively sustain operations is not a great start.

How do you improve something if you don’t know what good looks like? Approaching operating working capital improvements without understanding your Setpoint is akin to running in the dark. You are eventually bound to lose your way. And the faster you run, the further you stray from your intended destination.

In the world of operating working capital this often leads to cuts too deep or in the wrong places, creating new supply chain inefficiencies such as missing input materials, broken production schedules, costly overnight shipments, lost sales, and damaged relationships with suppliers and customers.

And by doing so, you end up creating incentives to build up new operating working capital buffers, often at higher levels than you had to begin with. Instead, diagnosing your operating working capital performance and fixing the underlying drivers of inefficiency will lead to more efficient processes and improved financial health.

By understanding your company’s operating working capital Setpoint you can easily identify problem areas warranting your attention, allowing you to direct your improvement efforts where it matters the most, setting relevant targets, without negatively impacting the business’ ability to perform.

3 Operating Working Capital Setpoint Considerations

- A Setpoint is company specific. It denotes the optimal position the company should sustain given its own current conditions and constraints (working capital or other).

It represents the best possible performance without any structural changes to existing processes or supply chain set-up. - A Setpoint is fact-based. It is calculated based on factual evidence, grounded in the structural set-up of your supply chain – not a subjective construct.

- A Setpoint is not a fixed value but a dependent variable. A company’s optimal working capital is directly affected by volume and changes to mix.

The absolute values can and will change over time, which is why a setpoint is defined as a dependent variable: in the case of working capital, typically expressed in days (e.g., Days Sales Outstanding, Days Payables Outstanding, Days Inventory Outstanding).

Eager to learn more? Check out our accredited e-learning course Managing Working Capital

Leave a Reply