Short-term Cashflow Forecast – Definition, application and considerations

This article explain what a short-term cashflow forecast is and why it is important. It will also provide insights into choice of forecasting horizons, what cash in- and outflow data is required, and how often it should be reviewed and updated.

Additionally, the article will also provide some simple tips and tricks for a successful implementation.

Key Take Aways

- The ability to convert profit into cash can mean the difference between success and failure in times of crisis, and a decisive competitive advantage when times are good.

- A company’s cashflow statement is a blunt instrument and provides little information about a company’s ability to meet its short-term financial obligations.

- Short-term cashflow forecasting (STCF) provides visibility of a company’s cash position within a chose forecasting horizon – typically 13 weeks.

- A STCF is based on cash inflows (receipts) and outflows (payments). It is built up from part actual and part forecast data.

- When installing a STCF, make sure to involve all relevant stakeholders, automate when you can, and routinely sanity check the outcome.

What is a Short-term Cashflow Forecast?

A short-term cash flow forecast (STCF) is fundamentally about providing visibility of a company’s cash position within a chosen forecasting horizon – typically 13 weeks.

Properly applied, a STCF will support and strengthen business decisions, provide early warnings of upcoming cash constraints. This enables timely counter measures as well as the ability to manage external stakeholders such as banks and shareholders.

Also, the wide variety of data sources feeding into the 13-week cash forecasting tool requires cross functional collaboration. This is to support the build–up of a healthy cash culture in the organization.

Learn more about Working Capital and Cashflow! Check out our accredited e-learning course: Managing Working Capital

Why is Cashflow important?

We live in an era where disruption is intensifying. Powerful global forces change how companies must we live and operate. This is not only through pandemics and/or environmental catastrophes, but through the continued rise of emerging economies, changing demographics and technological breakthroughs.

Although sales and profitability will continue to be a top priority, companies’ ability to convert profit into cash in a timely fashion will be a divider going forward. It can mean the difference between success and failure in times of crisis. And a decisive competitive advantage when times are good.

Situations can change fast, and when they do, control over cash is key.

Why Short-term Cashflow Forecast?

Liquidity and cash will play an even more vital role going forward. This place the balance sheet and operating working capital improvements in focus.

Companies who do not already have a short-term cashflow forecasting model in place do well in installing this. This would ensure increased transparency on an operational level, allowing for early warnings, scenario assessments and timely implementation of available rapid cash measures.

While a company’s cashflow statement will provide a snapshot overview of a company’s ability to convert its P/L into cash, it is a blunt instrument for reporting purposes only and provides little assistance to day-to-day operations.

This is where short-term cashflow forecast modelling comes into play.

Forecasting horizon

Most short-term cash flow forecasting models, regardless of industry, company size and/or location, are based on a 13-week rolling forecast horizon. This choice is not random:

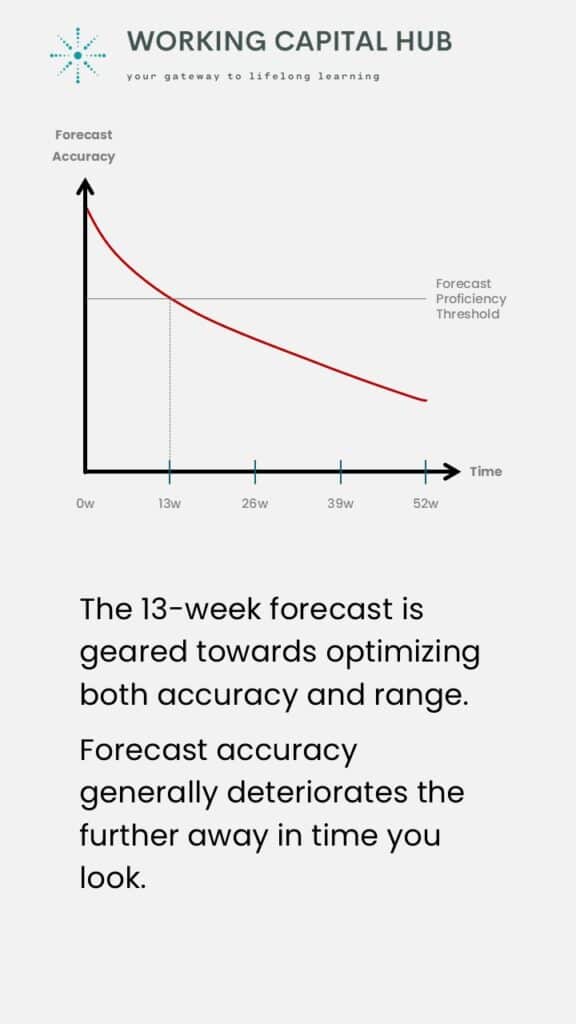

- The 13-week forecast is geared towards optimizing both accuracy and range. Forecast accuracy generally deteriorates the further away in time you look.

- The 13 weeks can be considered a sweet spot. It is close enough in time to allow for sufficiently accurate forecasts, while offering enough range to support mid-term planning and corrective actions when needed.

- A rolling 13-week forecast horizon always runs over next quarter-end. This is a key reporting date for many companies. This is because key stakeholders (e.g., investors and banks) look at quarterly reports to provide insights into business performance and growth.

Also, banks often use quarter-end cash forecasts to gauge covenant risk, as well as companies’ ability to service debts.

Short-term Cashflow Forecast reporting categories and input data

A STCF model is based on cash inflows (receipts) and outflows (payments). It is built up from part actual and part forecast data.

Always start with what you know. There is often a large portion of data on known future cash in- and outflows spread across the organization. This data could and should be captured by the STCF model:

- The Opening Cash Balance from the accounting system – reconciled to bank account.

- The Trade Payables and Receivables ledgers – adjusted for payment terms and ageing.

- Other known receipts or payments that will take place in the forecast period, and do not go through the payables or receivables ledgers. This include payroll runs, VAT payments, and refunds, interest in loans or principal repayments, planned maintenance and Capex, etc.

Once the known data is input into the forecasting tool, it is time to estimate future receipts and payments, beyond the ledger information.

- Cash receipts from future sales, based on best available information from sales. Data should be adjusted for payment terms and/or estimated customer payment behavior.

- Cash payments from future purchases, based on best available information from purchasing. Data should be adjusted for payment terms.

Using short-term Cashflow Forecast and the rapid cash toolbox

A STCF should be updated and actively reviewed on a weekly basis in a formalized format. The STCF forum should – from a cash perspective – assess and confirm the organizations’ ability to operate as planned in the forecast period.

If, or when, the tool identifies a period with low or negative cash, the forum should trigger corrective actions to either resolve the issue, or at least push the needle forward long enough to buy time to find a solution.

It is therefore also the role of the forum to keep a toolbox of short- and rapid cash release actions to quickly improve a pressed situation.

Successful implementation of these corrective actions should then be followed up and secured through short-interval feedback loops.

Tips and tricks to get started with short-term Cashflow Forecasting

- Involve all relevant stakeholders. Successful STCF data mining and forecasting depend on the involvement of stakeholders outside of finance and treasury departments. Any assumption or forecast data should come from the function closest to the issue, e.g., sales on sales forecast and purchasing on future spend.

- Automate where you can. However, do not fall in the trap of overcomplicating the installment of a STCF. Get the process moving quickly rather than accurately. It will improve fast with regular analysis and feedback.

- Routinely sanity check the output. Does the forecast trend make sense? What can we learn from deviations? Continuously update model assumptions to better reflect reality.

In summary, while short term cash control may not always feel top of the agenda, it can mean life or death for a company when the tide turns.

An ongoing STCF in combination with a solid short- and rapid cash release toolbox will prepare you well for this situation; and when the tide does turn you will be happy that you came prepared.

Eager to learn more? Check out our accredited e-learning course Managing Working Capital

Leave a Reply