Considerations when Benchmarking Working Capital

This article explores the use of Benchmarking Working Capital as a tool for evaluating a company’s performance.

It examines its relevance, highlights associated challenges, and outlines three key considerations companies should factor in when determining their optimal operating working capital needs.

Key Take Aways

- Operating Working Capital is important as it plays an important role in a company’s cash conversion cycle. It reflects the financial and operational health of a company.

- Benchmarking can be used to compare companies operating working capital performance. It is, however, difficult to find relevant peers.

- The optimal level of operating working capital is company specific, based on its individual supply chain set-up, conditions, and constraints.

- Also, in cases where a relevant peers can be found, most available and public operating working capital data is often too high level to provide relevant basis for comparison.

- Benchmarking working capital should be used with caution. It can provide useful information if applied correctly, as part of triangulating a company’s optimal working capital level.

Want to own this article? Download it for free at MyAcademyHub.com

Why is Operating Working Capital important?

Why should we talk about Operating Working Capital? Great question.

- First, operating working capital plays an instrumental role in the Cash Conversion Cycle. And cash should always be on management’s agenda.

- Second, we believe operating working capital ratios reflect the DNA of a company, providing vital insights into its health, agility, and growth potential.

Be that as it may, many companies struggle to understand their optimal operating working capital requirements – their Setpoint – let alone forecast what it should look like in the future (read more on optimal level of operating working capital here).

Despite being one of the larger capital investments many organizations make, operating working capital often lacks a clear strategy and approach, with insufficient accountability and control across the organization (unlike other larger cash-out items, such as Capex and cost).

This is because the true cost of operating working capital is much harder to gauge compared to other P&L or Balance Sheet items, and thus not always defined or implemented as part of decision-making processes.

Learn more about the importance of managing working capital – take our accredited e-learning course Managing Working Capital on MyAcademyHub.com!

Is Benchmarking Working Capital relevant?

Can you uncover a company’s optimal operating working capital requirements – its working capital Setpoint – by benchmarking its peer group’s performance?

The short answer is… yes and no. Benchmarking working capital can often create more questions than answers, especially with regards to working capital:

- An optimal operating working capital level is company specific – a working capital Setpoint denotes an optimal position a specific company should sustain given its individual current supply chain conditions and constraints.

- It is not easy finding relevant peers – to make a relevant comparison you would have to find a company with almost identical supply chain set-up, including product, customer, and regional mix.

- Available published financial data is too high level to provide relevant basis for comparison – even in cases when you would find a relevant peer, published P/L and Balance Sheet information does not provide the granularity required for precise comparison.

Challenges with Benchmarking Working Capital

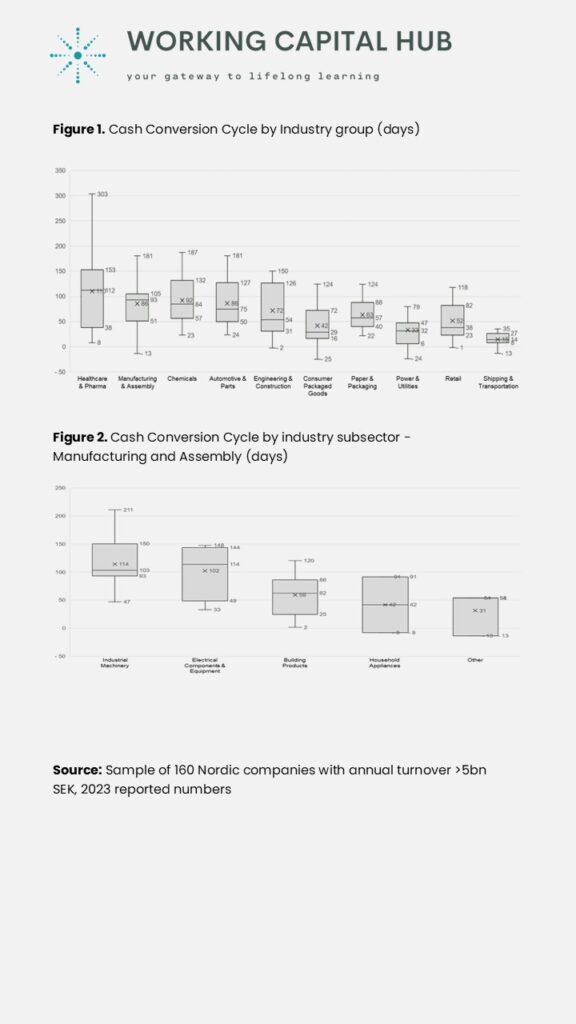

The challenges with benchmarking operating working capital using published data are made further apparent when looking at statistical analysis of the Cash Conversion Cycle within selected industries and its sub-sectors (see figure 1 and 2).

The variability within each industry group and its sub-sectors is striking. It is also too large to be caused by efficiency alone, but is rather explained by structural differences. This makes it hard – if not impossible – to know what a relevant comparison would be, as each company’s performance is based on its individual prerequisites and limitations.

Also, before you ask if we could possibly learn anything from the data averages, consider the statistician who drowned while crossing a river that he calculated was, on average, three feet deep (as wittingly stated by Sam Savage in HBR article: The Flaw of Averages, 2002).

With that said, we are not telling you to stop all benchmarking. Properly applied, you can still derive some useful information, as long as you understand and respect its limitations. It is well suited to picking up market trends, as well as triggering useful discussions, e.g., what are they doing differently?

What Operating Working Capital metrics should you Benchmark?

In cases where companies would want to approach benchmarking as a method to understand their operating working capital performance compared to recognized peers, the following metrics would be a good start (read more on working capital metrics and KPIs here).

- Working Capital Ratio: This ratio indicates a company’s ability to cover short-term liabilities with its short-term assets. It’s calculated as current assets divided by current liabilities.

- Operating Working Capital as % of Sales: OWC% measures how effectively a company can convert its invested operating working capital into sales.

- DSO (Days Sales Outstanding): DSO measures how long it takes for a company to collect payments from its customers.

- DIO (Days Inventory Outstanding): DIO measures how many days it takes for a company to sell its inventory.

- DPO (Days Payables Outstanding): DPO measures how long it takes for a company to pay its suppliers.

- CCC (Cash Conversion Cycle): CCC measures the time it takes for a company to convert its investments in inventory and other resources into cash flows from sales.

3 considerations when determining Operating Working Capital requirements

There are no shortcuts to understanding or achieving your working capital steady state. However, any company in pursuit of its optimal working capital level – its Setpoint – would do well in considering the following points:

- Be fact based and data driven – the answer is, as so often, in the details. Track and understand your transactional data, and make sure your Item Master data files and planning parameters are accurate and up to date. Quality information is the backbone in any supply chain organization. Read more about transaction data analysis here.

- Start by being the best YOU can be – before looking at anyone else, understand your own processes and lead-times: your supply chain conditions and constraints. There is no point striving for something you cannot achieve. Often there are plenty of incremental improvements to be made before it is time to look for structural change.

- Maintain an end-to-end process focus – align your stakeholders across the organization, and always keep your end-customer in mind. Avoid local sub-optimization due to unresolved supply chain biases and/or conflicting interests. Remember – a company is never better than the sum of its functions. Read more about supply chain bias here.

Eager to learn more? Check out our accredited e-learning course Managing Working Capital

Leave a Reply