Accounts Receivable: Complete Guide, Metrics & Best Practices

Accounts Receivable is more than “waiting to be paid.” It is a strategic balance between supporting customer growth and protecting your own liquidity. This guide explains AR fundamentals, credit risk, O2C processes, collections, metrics, financing tools, and future trends – showing how disciplined AR management turns reported revenue into real cash.

Accounts Payable: Complete Guide, Metrics & Best Practices

Accounts Payable is more than paying bills — it’s a financing tool, a supplier relationship lever, and a driver of working capital efficiency. This guide explores AP fundamentals, processes, metrics, strategy, regulation, and future trends.

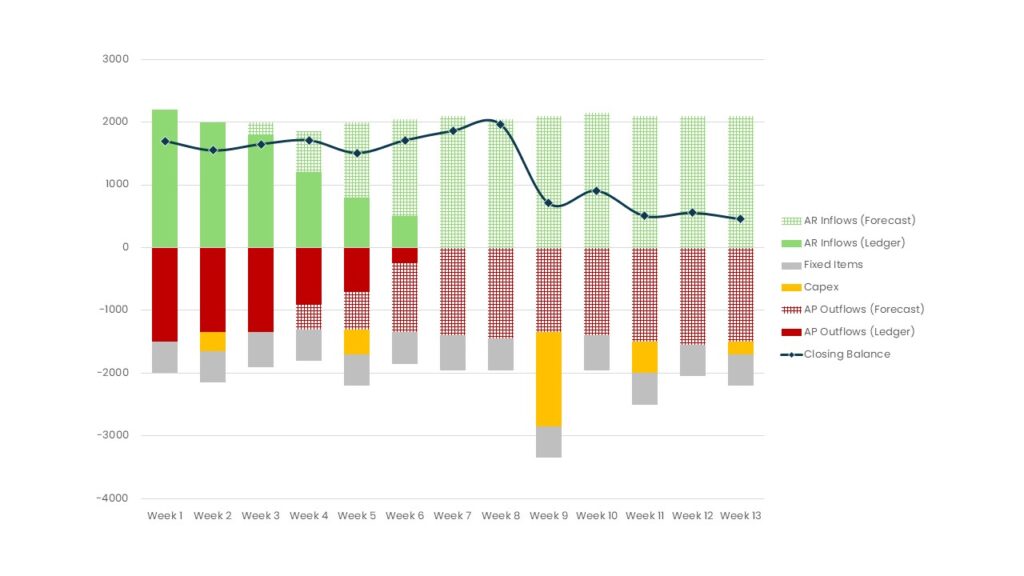

Short-Term Cash Flow Forecast (STCF): Definition, 13-Week Model, and Best Practices

Cash is lived daily, not just reported quarterly. A short-term cash flow forecast (STCF) gives companies the visibility to anticipate risks, make smarter decisions, and protect resilience. This in-depth guide explains why the 13-week horizon is the sweet spot, how to balance bottom-up detail with top-down efficiency, and the steps to create a forecast that works in practice. A must-read for finance and operations leaders seeking control over liquidity.

Purchase to Pay – Working Capital Hub’s Free Self Assessment Framework

The Purchase to Pay (P2P) cycle is more than just a back-office function – it’s a strategic driver of liquidity, supplier trust, and growth. From purchase requisition to supplier payment, P2P directly impacts operating working capital by optimizing cash outflows, strengthening supplier relationships, and improving compliance and efficiency. With Working Capital Hub’s free self-assessment framework, you can evaluate your P2P maturity, identify gaps, and unlock opportunities to enhance cash flow, resilience, and long-term financial flexibility.

Order to Cash – Working Capital Hub’s Free Self Assessment Framework

The Order to Cash (OTC) cycle is more than a back-office routine – it’s a strategic driver of liquidity, profitability, and customer satisfaction. How well a company manages OTC directly shapes its Operating Working Capital and cash flow performance. From order entry and credit checks to invoicing, collections, and dispute resolution, every step matters. A strong OTC process shortens payment cycles, reduces bad debt, and strengthens customer relationships, turning sales into cash more quickly and effectively.

Forecast to Fulfill – Working Capital Hub’s Self Assessment Framework

Unlock the full potential of your Forecast to Fulfill process with our Excel-based self-assessment framework. Evaluate each stage – from strategy to execution – using a simple 4-grade scale to identify strengths, gaps, and opportunities. Gain clear insights to streamline planning, boost efficiency, and accelerate your FtF maturity.