What is Operating Working Capital? Definition, formula, and application

This article explains what operating working capital is, what it consists of, and how to calculate it. It also provides insights in

Additionally, the article covers why operating working capital is important to a company and how it impacts the cash conversion cycle and cashflow. It also explores what constitutes good operating working capital and offers strategies to improve performance.

Key Take Aways

- Whilst Working Capital looks at a company’s short-term liquidity, Operating Working Capital looks at how effectively the company utilizes the capital it has tied up in operations.

- The operating Working capital metric includes only current assets and liabilities which are within a company’s core operational control. It represents the capital a company carries and must finance to support its day-to-day operations.

- OWC is calculated as Inventory + Accounts Receivable + Supplier Prepayments – Accounts Payable – Customer Prepayments.

- Companies require a certain level of operating working capital to operate smoothly and support day-to-day activities. This can be called a company’s operating working capital Setpoint.

- Too much operating working capital indicates an inefficient use of resources, whilst too little can cause process inefficiencies and lost sales. However, to read the symptoms companies must first understand their Setpoint.

- Operating working capital should always be looked at in relation to the business it is supporting. It is therefore often reported as a percentage of sales.

- OWC as a percentage of sales is calculated as OWC / Last 12 months Sales.

- Successful companies also look at the individual performance of inventories, accounts receivable, and accounts payable, to identify areas requiring focus and attention.

Working Capital vs Operating Working Capital

Two terms that often get confused are working capital and operating working capital. While these concepts may sound similar, they have distinct meanings and play different roles in a company’s financial reporting.

Working capital is a measure of liquidity, representing the capital a company has available to meet its short-term financial obligations. However, because it includes financial components, it does not always accurately reflect the performance of the company’s day-to-day operations (read more about working capital here).

Operating working capital, on the other hand, focuses solely on the operating components of the current assets and liabilities of a company. This more targeted view provides valuable insights into how effectively the company is utilizing the capital tied up in its operations:

- How effectively it supports the day-to-day operations & strategic direction of the business.

- How efficiently it can be converted into cash.

- And whether it is generating the desired return on investment.

Learn more about the importance of Operating Working Capital – take our accredited e-learning course Managing Working Capital on MyAcademyHub.com!

What is Operating Working Capital?

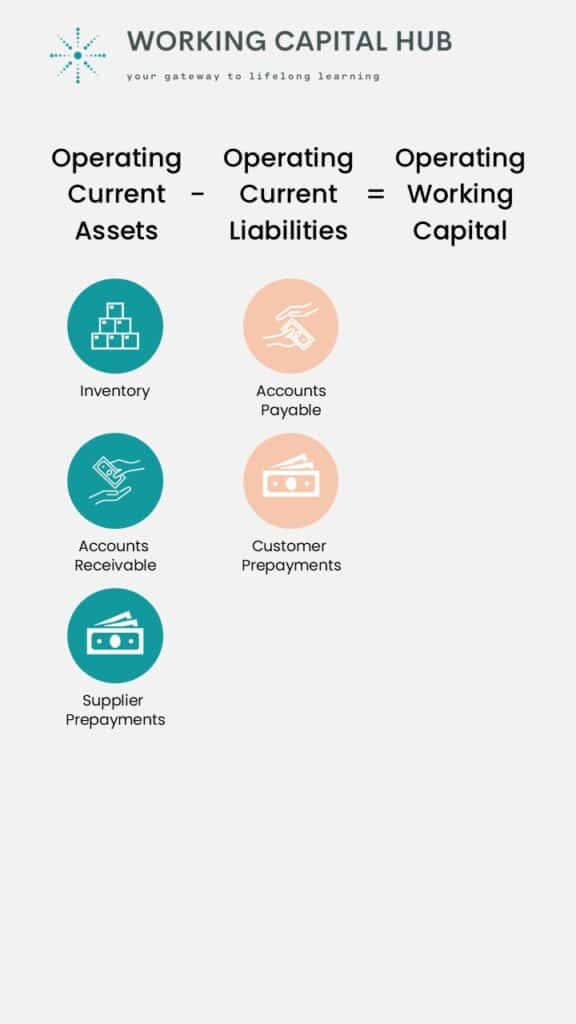

As mentioned before, the Operating Working Capital metric includes only a company’s operating current assets and liabilities. It thereby excludes items outside the company’s immediate operational control.

Financial items, such as payroll taxes, unpaid taxes, and payments on debt, are therefore excluded. Cash is also excluded as it is not directly affecting operations but is rather a consequence of how well the company performs.

- Operating current assets are resources utilized to generate revenue, essential for the continual functioning of a business. Examples of current operational assets include inventories, accounts receivable, and prepaid operating assets.

- Operating current liabilities, on the other hand, are liabilities resulting from the day-to-day activities of the business. It can be considered a free source of funding as they are non-interest bearing. Accounts payable and prepaid operating liabilities fall under this classification.

How is Operating Working Capital Calculated?

Operating Working Capital = Operating Current Assets – Operating Current Liabilities

Or:

Operating Working Capital = Inventory + Accounts Receivable + Supplier Prepayments – Accounts Payable – Customer Prepayments

Let us look at simple a calculation example:

- As of April 2024, a company reported 140m of operating current assets, which included inventory, accounts receivable and supplier prepayments.

- The company also reported operating current liabilities of 55m, which comprised of accounts payable and customer prepayments.

- Therefore, as of April 2024, the company’s operating working capital metric was 85m (140-55).

What is Good Operating Working Capital?

Operating working capital optimization is not about wildly cutting inventories or running the business on a shoestring. It is about understanding the circumstances of a business, making sure you are not under- or over-serving customers, tailoring operations to strike a balance between service and cost.

The winner is not necessarily the one with the least operating working capital, but the one with the right operating working capital.

All companies require a certain level of operating working capital to effectively support its operations and deliver a healthy cash flow. The trick is understanding what this level is to avoid creating inefficiencies along the way.

What is too much?

- Too much operating working capital is an indication of inefficient use of resources. This is because idle assets do not generate returns, and cost money to maintain. It could further mean that a company has less available cash, as it is used to fund the company’s operating cycle.

- Excess levels are also strong symptoms of hidden process inefficiencies. These often result in inventory buffers, inefficient invoicing- and collection processes, as well as lax purchasing practices. In essence, excess operating working capital signals a misalignment between the company’s operational requirements and its operating working capital resources, hindering its ability to capitalize on growth opportunities and maximize profitability.

What is too little?

- On the other hand, too little operating will create process inefficiencies, as the company may struggle to meet customer demand due to insufficient inventory or production capacity. This can lead to missed sales opportunities, costly overnight shipments, delayed deliveries, and strained customer relationships.

- Moreover, too low levels of operating working capital can place a company in a state of perpetual firefighting, limiting its ability to proactively take advantage of supplier discounts or negotiate favorable terms, further exacerbating cost pressures. In essence, operating below the optimal working capital level constrains the company’s ability to operate efficiently, compete effectively, and sustain long-term growth.

The challenge is of course, to read and act on these symptoms, a company must first understand and its baseline operating working capital requirements. Working Capital Hub calls this equilibrium a company’s operating working capital Setpoint. Read more about the Operating Working Capital Setpoint here.

Positive vs Negative Operating Working Capital

A company whose short-term operating assets are greater than its short-term operating liabilities (a positive OWC) will require short-term funding, to finance the cash tied up in operations.

Conversely, a company whose short-term operating liabilities are greater than its short-term operating assets (a negative OWC) does not require any additional funding. This is because it is effectively funded by its suppliers or through customer pre-payments.

Although a negative operating working capital is a useful source of free funding for companies, it is not appropriate nor achievable for all businesses. It can predominantly be found in industries with high inventory turnover and where customer payments are received immediately against sales. Grocery stores and retailers can be found in this category. It is also prevalent in industries where customer pre-payments are common, such as construction projects.

However, operating with negative operating capital is not without risk. Companies who rely on negative operating capital to finance its operations are sensitive to changes in demand. A sudden or unexpected drop in sales or inflow of customer pre-payments would create a funding gap the company must resolve.

Companies with negative operating capital should therefore always track its short-term cashflow forecast diligently. This will help identify risks and allow for proactive counter measures if the situation changes.

How do you Evaluate Operating Working Capital?

Looking at operating working capital as an absolute value makes little sense.

Consider two companies with the same net operating working capital of 100. Are they performing well? It is hard to draw any conclusions based on this information alone.

However, if we were told that one company uses its operating working capital to generate sales of 500, whilst the other manages to generate sales of 1000, it is easier to have an opinion.

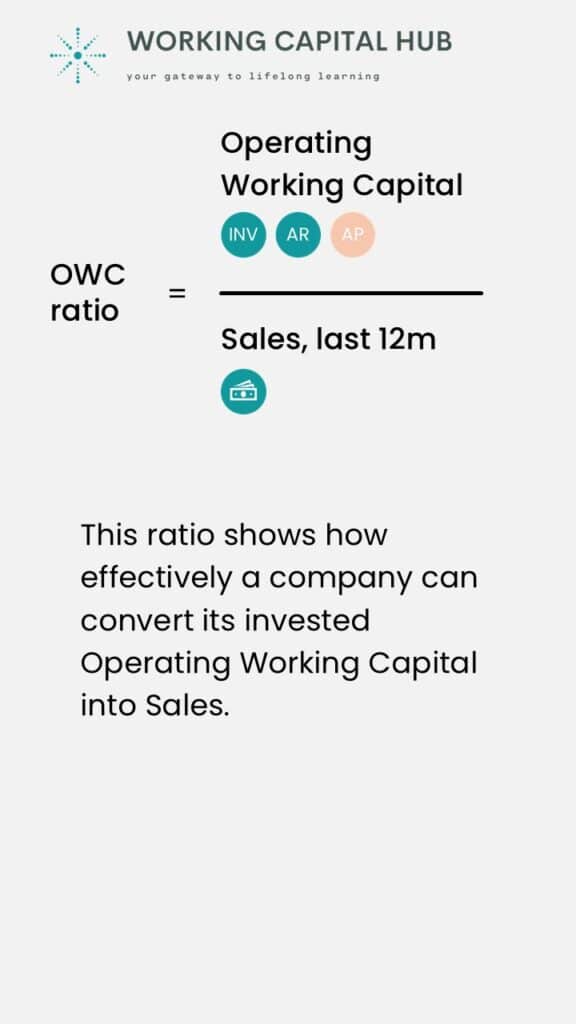

Operating working capital divided by sales is therefore a common metric, showing how effectively a company can convert its invested operating working capital into sales.

The formula for calculating OWC ratio is:

OWC Ratio = OWC / Last 12 months Sales

This relative measurement is effective when following progress over time, visualizing a company’s aggregated operating working capital performance and its trend. The higher the sales a company can generate from its operating working capital, the more efficient it is.

It can also be used to benchmark against relevant peers. However, as always, benchmarks should be approached with caution, as it can be difficult finding relevant companies to compare to (read more on benchmarking working capital here).

Successful management of operating working capital also means measuring the individual performance of inventories, accounts payable and accounts receivable. An efficient working capital practice therefore uses additional key performance ratios, such as return on working capital, inventory ratios, collection ratios, and payment ratios, to help identify areas that require focus to maintain liquidity and profitability (read more on working capital ratios here).

10 Ways to Improve the Operating Working Capital

Here are some strategies to improve your working capital:

- Optimize Inventory Management: Keep inventory levels optimized to prevent overstocking or stockouts. Align system applied target inventory and safety stock requirements to demand profile and required service levels. Implement demand-driven or just-in-time inventory systems to reduce excess inventory holding costs.

Actively work to reduce slow-moving or obsolete inventories, as these can take up space at the expense of in-demand high runners. - Streamline Customer Invoicing and Collection: Accelerate the collection of accounts receivable by sending correct and timely invoices and following up promptly on overdue accounts. Implement pre-dunning for habitual late payers. Actively work to reduce dispute resolution time.

Also, consider implementing stricter credit policies to reduce the risk of late payments or defaults. - Manage Supplier Invoice Receipt and Payments: Ensure swift and accurate goods receipt and system entry practices. Make sure applied payment terms are aligned with supplier agreements. Pay on time but also identify and avoid payments made earlier than the due date.

Also, for invoices due on a weekend, consider making the payment the following Monday rather than the Friday before, as no transfers will take place over the weekend anyways. - Improve Operational Efficiency: Streamline workflows, invest in technology, and train all staff to work more effectively. Enhance operational efficiency to reduce waste, re-work as well as internal lead-times. Identify and remove bottlenecks.

Ensure frozen production plans to maintain optimal sequencing. Shorten change-over and ramp up time. - Improve Sales Efficiency: Actively work towards favorable payment terms as part of all customer negotiations. Assist collection in cases of disputes or habitual late payers. Improve forecast accuracy and align demand and supply through active participation in Sales and Operations Planning processes.

Align forecasts with relevant planning horizons, and make sure they are presented in a format relevant for operations (in same unit as used for planning purposes). - Improve Purchasing Efficiency: Actively work towards favorable payment terms as part of all supplier negotiations. Also, weigh in implications of longer delivery lead times when selecting suppliers: understand the implications on inventory and cost of capital. Review current supplier agreements and identify suppliers with terms shorter than policies allow.

Ensure only approved suppliers are used and align service level agreements across the organization. Reduce complexity by consolidating the number of suppliers or purchased items to improve both terms and cost. - Monitor Working Capital & Cashflow: Regularly monitor key working capital metrics and ratios to identify areas for improvement and track progress over time. Include relevant leading metrics to allow for early recognition of inefficiencies.

Install working capital reporting and follow-up in relevant management meetings as a fixed agenda point. Assign ownership and accountabilities. - Set & Align targets Across Functions: Ensure relevant and achievable targets, aligned with the company’s optimal working capital levels. Balance targets across functions to avoid conflicting agendas, and local optimization at the expense of the total business.

Ensure working capital and cash are high on the management’s agenda and connected to relevant incentive structures. - Utilize Working Capital Financing: Explore various working capital financing options such as Supply Chan Financing (e.g., Receivables Financing, Approved Payables Financing, etc.). Ensure to evaluate the cost-effectiveness of financing options.

- Regularly Review and Adjust Strategies: Continuously monitor your working capital management practices and adjust them as needed based on changes in market conditions, business performance, or other factors impacting liquidity.

By implementing above strategies, a company will improve its working capital and strengthen its financial position, ultimately enhancing its ability to meet short-term obligations and support long-term growth.

Eager to learn more? Check out our accredited e-learning course Managing Working Capital,

Leave a Reply