Strong Operating Working Capital Practices Influence Profitability

This article explains how strong operating working capital practices influences not only a company’s cash conversion cycle, but also its topline and cost.

The article will provide examples of how sustained improvements to operating working capital affect companies profitability, why cross functional participation is key, as well as the role of operations in ensuring a successful outcome.

Key Take Aways

- Companies with strong Operating Working Capital practices tend to have higher profit margins.

- This is because released trapped cash can be effectively reinvested into the business.

- Sustained improvements to operating working capital and the Cash Conversion Cycle also relies on similar core process improvements as traditional productivity enhancing exercises.

- Conversely, companies with singular focus on cost-out activities often experience deteriorating operating working capital performance, impacting Cashflow negatively.

- Lean Operating Working Capital management is not only a finance concern but relies heavily on the active involvement of operations.

- Convincing operational leaders, including the chief operating officer and chief procurement officer, of the direct impact of Lean Operating Working Capital on profitability is crucial.

- Aligning their focus with operating working capital efficiency goals fosters a culture of operational excellence. It also drives organizational-wide commitment to optimization efforts.

Want to own this article? Download it for free at MyAcademyHub.com

Operating Working Capital and Profitability

Operating working capital (OWC) and profitability are two crucial measures used by businesses to assess their financial health and efficiency.

- OWC represents the amount of capital that a business requires and must fund to support its day-to-day operations. This includes a company’s inventory, accounts receivable, and accounts payable.

Managing operating working capital effectively is essential for maintaining liquidity and ensuring smooth operations. - Profitability measures a company’s ability to generate profit relative to its revenue, operating assets, or equity. It indicates how efficiently a company is utilizing its resources to generate earnings.

Profitability can be assessed through various metrics. These include gross profit margin, operating profit margin, net profit margin, return on operating working capital (ROWC), and return on equity (ROE). Read more on Working Capital Metrics here.

A company with higher profitability ratios is generally considered more financially sound and attractive to investors.

The significance of operating working capital in profit metrics like return on operating assets is evident. This metric will gauge a company’s efficiency in converting its invested capital into profits.

Nonetheless, many organizations fail to recognize the considerable influence that a sustained reduction in operating working capital also can have on other key performance indicators such as profit margin.

Learn more about how strong operating working capital practices help optimize a company’s profitability. Take our accredited e-learning course Managing Working Capital on MyAcademyHub.com!

Improving Profitability Through Lean Operating Working Capital Management

While the direct link between operating working capital and a company’s profit margin might not always be apparent, there exists a strong indirect correlation.

Companies with strong operating working capital practices tend to have higher profit margins, as:

- Strategic deployment of released cash. Optimizing operating working capital releases trapped cash which can be strategically reinvested in growth initiatives. Such initiatives include acquisitions, product enhancements, and market expansions, ultimately boosting revenue and margins.

It can also be used to reduce the reliance of expensive short-term borrowing, such as overdraft-or working capital facilities, lowering interest expenses. - Improving availability and responsiveness to demand fluctuations. Optimized operating working capital plays a pivotal role in improving the availability of the right goods at the right time. This will in turn enhance pick rates, and minimize stockouts.

This allows the company to effectively meet customer demand and maximize sales opportunities. It also enables businesses to respond nimbly to fluctuations in demand. By facilitating agile procurement, production, and distribution processes, ensuring that products are readily available when needed. - Boosting efficiency and cost effectiveness. It is crucial to recognize that both cost improvements and improved operating working capital practices rely heavily on similar core process enhancements.

This includes better resource allocation, improved right first time and reduction of waste. By identifying Supply Chain Bias, removing inefficiencies and streamlining operations, companies create a solid foundation for sustainable growth and profitability. - Streamlining operations and scalability. Companies with strong and mature operating working capital practices generally operate their supply chain with fewer full-time equivalent resources (FTEs).

These advanced companies also tend to operate on a more centralized basis with more modular and scalable processes, and with lower transaction costs.

The impact of Strong Lean Operating Working Capital Practices

The collective impact from lean operating working capital improvement initiatives results in much more than just cash-related benefits, impacting also top-line and cost.

Operating working capital optimization offers businesses a multifaceted strategic advantage, encompassing improved availability of goods, enhanced responsiveness to demand fluctuations, and streamlined operational performance.

By optimizing operating working capital, businesses can unlock operational efficiencies, drive strategic growth initiatives, and cultivate resilience in today’s rapidly evolving marketplace.

Embracing working capital optimization as a fundamental pillar of financial management empowers businesses to thrive in an ever-changing business landscape. Also, a key advantage of operating working capital projects is their minimal disruption to organizations.

Unlike large-scale cost-out or restructuring initiatives, which can cause significant upheaval and distress, working capital optimizations are tactical in nature, seamlessly integrated into existing workflows with minimal disruption.

Does Improved Operating Working Capital Drive Profitability, or is it the Other Way Around?

There are multiple studies exploring the relationship between operating working capital and profitability. One of the stronger ones we have come across originates from the Hackett Group.

Hackett Group analyzed a comprehensive data set from 1,000 publicly traded companies. They looked at their profitability (gross margin and EBITDA margin), capital efficiency (return on capital employed) and shareholder value (EVA) over a period of 10 years.

This study pointed to a strong relationship between operating working capital improvements and improvements to the evaluated metrics. The study concluded that a focus on operating working capital optimization could improve the EBITDA margin by as much as 1% for every 7-day sustained improvement to the Cash Conversion Cycle.

But what about the other way? Could it be an increased focus on profitability that leads to improved operating working capital performance?

Based on empirical evidence from more than 100+ working capital projects and reviews over the past decade, I say: not the case.

What is evident is that companies with a singular cost-out focus will rather experience deteriorating operating working capital performance as a direct result. This is because traditional cost-out exercises are disruptive to organizations. They often create temporary inefficiencies that are commonly offset through utilization of working capital buffers.

Also, traditional cost-out exercises are often narrow in scope. They look only at the direct impact on a company’s profit and loss statement, without considering implications for the balance sheet and the supply chain in full. Examples of this could be:

- Cutting supplier spending. Companies looking to reduce supplier spend often negotiate volume or early payment discounts. Alternatively look for lower cost sourcing from countries far away.

However, such actions have a significant impact on companies’ inventory or accounts payable, which is often neglected. - Improving productivity. Companies looking to improve productivity often increase production batches to gain scale benefits and improve fixed cost absorption.

However, productivity gains without a corresponding increase in demand would lead to increased inventories if not managed correctly. - Reducing headcount. Companies focusing solely on reducing headcount to cut costs often fail to consider the broader implications on productivity, quality, and innovation.

This narrow focus on immediate cost savings can lead to a shortage of resources in key areas that are often considered non-value added but critical for long-term success. Such activities include quality control, continuous improvement initiatives, research and development, and customer support.

These shortages in turn often put a strain on companies operating working capital by delaying receivables, exacerbating inventory management challenges, impacting supplier relationships, and reducing overall flexibility.

To summarize, whilst improved operating working capital practices often have a positive impact om companies profit margins, traditional cost-out initiatives often lead to deteriorating operating working capital performance.

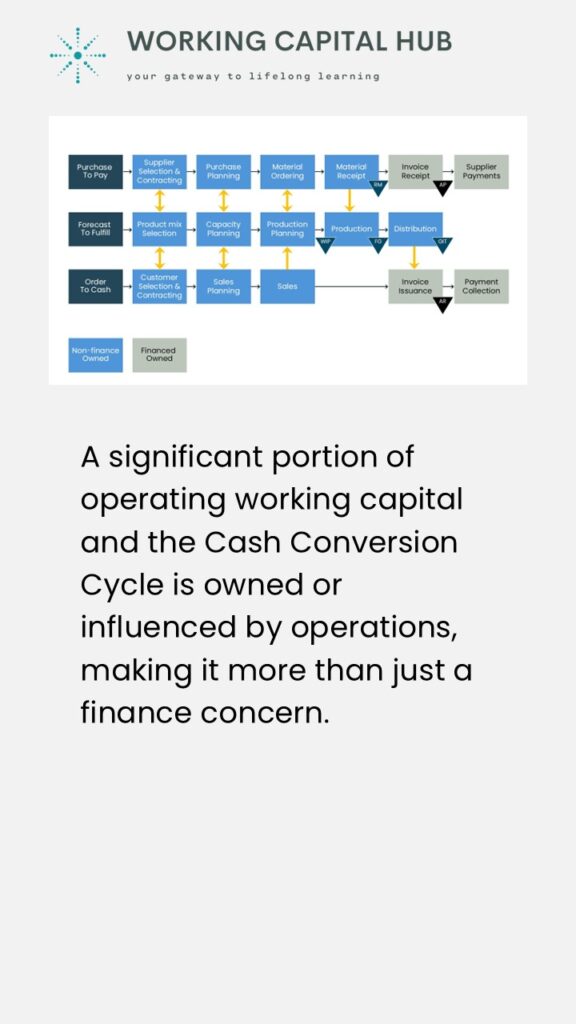

Why Cross Functional Buy-in is Critical for Sustainable Operating Working Capital Improvements

Operating working capital management is often viewed as a finance-centric function due to its direct relationship with cash. However, it is essential to recognize the critical role that operations play in the process.

This because a significant portion of operating working capital and the Cash Conversion Cycle is owned or influenced by operations, making it more than just a finance concern. These processes are highly interconnected, highlighting the importance of a holistic cross-functional approach.

Convincing operational leaders, including the chief operating officer and chief procurement officer, of the direct impact Lean Operating Working Capital has on profitability is crucial to ensure focus and commitment.

Aligning their focus with operating working capital efficiency goals fosters a culture of operational excellence and drives organizational-wide commitment to optimization efforts.

The Role of Operations in Lean Operating Working Capital Management

Here’s how operations contribute to the cash conversion cycle and why their involvement is crucial for achieving not only lasting operating working capital improvements:

- Inventory Management. Efficient inventory management practices, such as just-in-time (JIT) inventory systems or lean manufacturing principles, can significantly reduce the amount of cash tied up in inventory, thus shortening the cash conversion cycle.

Operations teams are responsible for managing inventory levels to ensure that they meet customer demand while minimizing excess stock. - Production Efficiency. Streamlining production processes and reducing lead times can accelerate the pace at which finished goods are produced and sold, ultimately speeding up cash inflows.

Operations teams are instrumental in identifying and implementing process improvements that enhance production efficiency and reduce costs. - Quality control. Maintaining high product quality minimizes the risk of returns, rework, and warranty claims, which can tie up cash and increase operating expenses.

Operations teams are responsible for implementing quality control measures to uphold product standards and minimize defects. - Customer fulfillment. Timely order fulfillment and delivery are essential for generating cash inflows from sales.

Operations teams play a vital role in ensuring that customer orders are processed efficiently, products are delivered on time, and invoices are promptly issued to facilitate timely payment collection. - Purchasing. Collaborating closely with suppliers to optimize payment terms and replenishment volumes, streamline the supply chain, and negotiate discounts will help free up cash and improve working capital efficiency.

Purchasing plays a critical role in optimizing a company’s operating working capital. - Sales. Negotiating customer payment terms are a key component of a company’s operating working capital management. It should always be balanced against price, delivery lead time and service level requirements.

The sales department is also critical in its role of producing updated and relevant demand forecasts, improving predictability of future demand.

While finance executives typically oversee the measurement and governance of operating working capital performance, they rely heavily on the collaboration and support of operations to achieve sustainable improvements.

Without operations’ involvement in optimizing inventory management, production efficiency, supplier relationships, customer fulfillment, and quality control, finance may struggle to drive meaningful and lasting working capital improvements.

Therefore, fostering collaboration between finance and operations is essential for maximizing cash flow, improving profit margins, and optimizing working capital management across the organization.

Eager to learn more? Check out our accredited e-learning course Managing Working Capital

Leave a Reply