What is Working Capital? Definition, formula, and application

This article explains what working capital is, what it consists of, and how to calculate it. It also provides insights into its role in ensuring a company can meet its short-term financial obligations.

Additionally, the article covers why working capital is important to a company and how it impacts cash flow. It also explores what constitutes good working capital and offers strategies to improve performance.

Key Take Aways

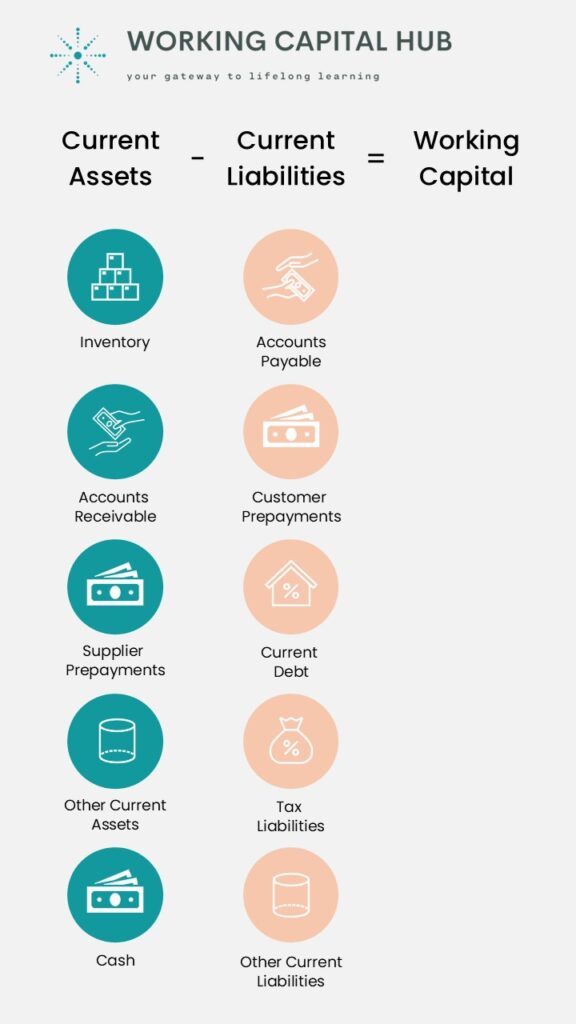

- Working capital is a financial metric calculated as the difference between current assets and current liabilities.

- These items can be found on a company’s balance sheet.

- Current assets are any assets that can be converted to cash in 12 months or less.

- Current liabilities are financial obligations that come due in 12 months or less.

- The working capital metric tells if a company holds sufficient cash and cash equivalents to pay its short-term financial obligations (Its liquidity).

- Cash in turn is dependent on how fast a company can convert its working capital into sales and customer payments.

- Working capital performance provides insights into the financial health of a business. Therefore, understanding the concept of working capital is crucial for entrepreneurs, managers, investors, and stakeholders alike.

- In order to understand a company’s operational health, including its return on capital and efficiency, a company must also look at its operating working capital.

What is Working Capital?

Working Capital represents the capital a company has available to meet its short-term financial obligations. It is defined as the difference between a company’s current assets and current liabilities, which can be found on a company’s balance sheet.

This financial metric tells if a company holds sufficient cash and cash equivalents to pay its short-term financial obligations. Cash equivalents, such as inventory and customer credits, are non-cash items that are expected to convert into cash within one operating cycle, often one year.

- A positive working capital indicates that a company has more current assets than current liabilities. This implies that it possesses sufficient liquidity to cover its short-term obligations.

- Conversely, a negative working capital suggests that a company may struggle to meet its short-term financial commitments. This in turn indicate liquidity issues and operational challenges.

How is Working Capital Calculated?

Working Capital = Current Assets − Current Liabilities

What are Current Assets?

The current assets refer to short-term assets that a company owns, benefits from, or uses to generate income. These assets are classified as current because they are expected to be consumed or converted into cash within an operating cycle, typically within a year.

Conversely, the current assets are used to support day-to-day operational activities and expenses, and they include cash, inventories, accounts receivable, prepaid expenses, and other current assets.

- Cash – includes all the money a company has on hand.

- Inventory – Includes the combined value of Raw Materials, Work in Progress & Finished Goods that a company owns.

- Accounts Receivable – includes the combined value of all customer invoices which have not yet been paid.

- Pre-paid expenses – includes the combined value of all expenses that have been paid for in advance, but have not yet incurred (e.g., supplier pre-payments).

- Other current assets – this balance includes the combined value of current assets that are considered uncommon or otherwise insignificant to the core operations of the business.

What are Current Liabilities?

Current liabilities refer to short-term obligations and debt that a company carries to finance its assets. These liabilities are classified as current because they are expected to be settled within an operating cycle, typically within one year.

They include items such as accounts payable, unearned revenue, wages payable, the current portion of long-term debt, unpaid taxes, and other short-term debt due within one year.

- Accounts payable – includes the combined value of all supplier invoices which have not been paid.

- Unearned revenue – includes the combined value of all capital received in advance of having completed work (e.g., customer pre-payments).

- Wages payable – includes all accrued salary and wages for employees, which have not yet been paid out.

- Current portion of long-term debt – includes the combined value of all short-term payments (due within 12 months) related to the long-term debt.

- Unpaid taxes – includes the combined value of tax obligations.

- Other current liabilities – this balance includes the combined value of current liabilities that are considered uncommon or otherwise insignificant to the core operations of the business.

Learn more about the importance of Working Capital – take our accredited e-learning course Managing Working Capital on MyAcademyHub.com!

Why is Working Capital management important?

Above all, working capital management is about ensuring a company is utilizing its current assets and current liabilities as effectively as possible.

- [Strategic] Making sure the operating working capital support a company’s overall strategic direction, and generates a desired return.

- [Tactical] Making sure a company’s working capital facilitates sufficient cash flow to meet its short-term operating costs and short-term debt obligations (liquidity).

- [Operational] Making sure a company’s operating working capital effectively supports day-to-day operations (efficiency & effectiveness).

In brief, the hallmark of strong business practices is the ability to manage its working capital in a way in which it allows the company to maintain a solid balance between liquidity, growth and profitability.

Note that in order to manage its strategic and operational perspectives, a company must look to its operating working capital. You can read more on this under section Limitations of the working capital metric below.

How does Working Capital Affect a Company’s Cashflow?

Without generating sufficient available cash, a company will struggle to perform its routine activities. These include purchasing goods and services, paying employee salaries, making investments, financing growth, or servicing debt.

Cashflow is directly influenced by the company’s ability to convert its working capital assets into sales and customer payments. This is because items such as unsold inventory and unpaid customer invoices represent cash tied up in operations.

Let’s look at an example to illustrate this. Imagine a company experiencing a 20-unit increase in operating profit over a period. Naturally, we would expect the company’s operating cash flow to increase by 20 as well.

However, suppose the company needed to acquire an additional 10 units of inventory to support the sales growth. Furthermore, unpaid customer invoices increased by 15 units, as some of the new sales occurred in regions with extended payment terms.

This means an additional 25 units are now tied up in operations as working capital. As a result, the operating cash flow for the period would not be 20, but instead -5. (Operating profit of 20 minus the 25 increase in working capital).

Therefore, in business management and financial analysis, working capital is a critical metric. This is because it reflects a company’s financial health, operational efficiency, growth readiness, and ability to meet short-term obligations. Read more about working capital and cashflow here.

What is good Working Capital?

Working capital requirements vary across industries and can even differ between similar companies. This variation is in turn driven by several factors. These include regional differences in commercial terms, collection and payment policies, timing and lead times for purchases and production, and the need to maintain inventory.

For example, a company that sources most of its materials from distant suppliers will have longer replenishment lead times and therefore higher inventory requirements than a company sourcing from nearby suppliers.

Similarly, a company selling products or services to regions with longer customer payment terms will have more capital tied up in accounts receivable compared to companies operating in regions with shorter payment terms.

However, what remains common is that companies must ensure they can meet their short-term financial obligations. When a company has more short-term debt than short-term assets, it may face challenges in covering payrolls or paying suppliers each month.

Many companies therefore track their Working Capital Ratio (also called the current ratio) to monitor liquidity.

What is the Working Capital Ratio?

Working capital ratio = Current assets / Current liabilities

The working capital ratio (alco called the current ratio) helps illustrate how much of a company’s revenues will be used to meet payment obligations in the period. And, consequently, it shows how much cash the company will have left for new opportunities such as financing growth or capital investments.

- A common rule of thumb is that a ratio between 1.5 and 2 is considered good. This suggests the company has sufficient funds on-hand to facilitate its short-term debt, and at the same time provide flexibility to finance growth and investments.

- A ratio greater than 3 can at the same time suggest that a company is not utilizing its assets effectively. Too high levels of idle capital indicate an inefficient use of resources. These could instead be invested to generate even higher future returns, through e.g., new product or service development, new market entries, etc.

10 ways to improve Working Capital

Here are some strategies to improve your working capital:

- Optimize Inventory Management: Keep inventory levels optimized to prevent overstocking or stockouts. Align system applied target inventory and safety stock requirements to demand profile and required service levels. Implement demand-driven or just-in-time inventory systems to reduce excess inventory holding costs. Actively work to reduce slow-moving or obsolete inventories, as these can take up space at the expense of in-demand high runners.

- Streamline Customer Invoicing and Collection: Accelerate the collection of accounts receivable by sending correct and timely invoices and following up promptly on overdue accounts. Implement pre-dunning for habitual late payers. Actively work to reduce dispute resolution time. Also, consider implementing stricter credit policies to reduce the risk of late payments or defaults.

- Manage Supplier Invoice Receipt and Payments: Ensure swift and accurate goods receipt and system entry practices. Make sure applied payment terms are aligned with supplier agreements. Pay on time but also identify and avoid payments made earlier than the due date. Also, for invoices due on a weekend, consider making the payment the following Monday rather than the Friday before, as no transfers will take place over the weekend anyways.

- Improve Operational Efficiency: Streamline workflows, invest in technology, and train all staff to work more effectively. Enhance operational efficiency to reduce waste, re-work as well as internal lead-times. Identify and remove bottlenecks. Ensure frozen production plans to maintain optimal sequencing. Shorten change-over and ramp up time.

- Improve Sales Efficiency: Actively work towards favorable payment terms as part of all customer negotiations. Assist collection in cases of disputes or habitual late payers. Improve forecast accuracy and align demand and supply through active participation in Sales and Operations Planning processes. Align forecasts with relevant planning horizons, and make sure they are presented in a format relevant for operations (in same unit as used for planning purposes).

- Improve Purchasing Efficiency: Actively work towards favorable payment terms as part of all supplier negotiations. Also, weigh in implications of longer delivery lead times when selecting suppliers: understand the implications on inventory and cost of capital. Review current supplier agreements and identify suppliers with terms shorter than policies allow. Ensure only approved suppliers are used and align service level agreements across the organization. Reduce complexity by consolidating the number of suppliers or purchased items to improve both terms and cost.

- Monitor Working Capital & Cashflow: Regularly monitor key working capital metrics and ratios to identify areas for improvement and track progress over time. Include relevant leading metrics to allow for early recognition of inefficiencies. Install working capital reporting and follow-up in relevant management meetings as a fixed agenda point. Assign ownership and accountabilities.

- Set & Align targets Across Functions: Ensure relevant and achievable targets, aligned with the company’s optimal working capital levels. Balance targets across functions to avoid conflicting agendas, and local optimization at the expense of the total business. Ensure working capital and cash are high on the management’s agenda and connected to relevant incentive structures.

- Utilize Working Capital Financing: Explore various working capital financing options such as Supply Chan Financing (e.g., Receivables Financing, Approved Payables Financing, etc.). Ensure to evaluate the cost-effectiveness of financing options.

- Regularly Review and Adjust Strategies: Continuously monitor your working capital management practices and adjust them as needed based on changes in market conditions, business performance, or other factors impacting liquidity.

By implementing above strategies, a company will improve its working capital and strengthen its financial position, ultimately enhancing its ability to meet short-term obligations and support long-term growth.

Limitations of the Working Capital metric

The working capital metric is not a comprehensive representation of a company’s short-term liquidity or long-term solvency. It only provides a snapshot of performance at a given moment.

One limitation of the working capital metric is that it combines both financial and operational elements, which restricts visibility into the company’s core operations. This makes it difficult to effectively assess the day-to-day operational performance based solely on this metric.

Additionally, the metric does not account for the quality of operating current assets. These assets can include items that may not be easily converted into cash, such as slow-moving or obsolete inventory.

For example, a company with a working capital ratio of 1.5 might seem to be performing well in terms of short-term liquidity. However, if a significant portion of its current assets consists of slow-moving inventory or disputed invoices, the company could still face challenges in meeting its short-term financial obligations.

On the other hand, a company whose current assets are largely in cash may have no difficulty meeting immediate payment requirements. Yet, if it lacks sufficient inventory to fulfill upcoming sales demand, it could face operational issues despite appearing liquid.

To better assess the quality of operational elements, many companies also measure and track their operating working capital (also known as trade working capital).

This metric includes only items within a company’s core operational control and represents the capital needed to support day-to-day operations. Learn more about operating working capital here.

In summary, while the working capital metric provides useful insights, it is essential to supplement it with other financial analyses to gain a clearer picture of a company’s operational efficiency and financial health.

Eager to learn more? Check out our accredited e-learning course Managing Working Capital

Leave a Reply